Aside from being my birth month, I’m glad that Sun Life has declared it also as the Financial Independence Month. Last Tuesday, I was blessed to attend Sun Talks – – wherein speakers shared advices to live a brighter life through life, health and wealth solutions.

Below are some of the major takeaways I got from Sun Talks:

1) On life: Know your “why”

The first inspiring talk was given by Krie Lopez, Founder & CEO of Messy Bessy. She stressed the importance of finding and acting on your purpose.

To live a brighter life, you must know your “why”.For me it’s all about changing lives and providing opportunities through my enterprises

2) On health: Overhaul your nutrition and eating habits

Photographer and wellness advocate Sara Black shared to the attendees her personal experience which helped her find radiance. On her 30s, she had a breast cancer scare and this made her start her wellness journey.

Stop focusing on what’s lacking and think about what you have now that you can be grateful for. When we shift our mindset from lack to abundance, that’s when we can achieve prosperity. You can start your wellness journey now or when you’re 90. The only thing that can hinder you is your own thoughts.

3) On wealth: the ultimate purpose of wealth is to love people.

I’ve always wanted to attend Bo Sanchez’s talk and I’m thankful that Sun Life made it possible. Aside from being a lay preacher, he is also an author and entrepreneur. During his childhood years, he thought that money was evil but it was during his ministry years that he realized that money can be of help to the people especially in their families.

EARN as much as you can, so you can GIVE as much as you can.

Sanchez also encourages people to invest in mutual fund. In fact, his maids who invested years ago will now be a millionaire by the time they retire.

Unfortunately, not all Filipinos have the same mindset like Sanchez’s maids. According to a nationwide study of 1,200 respondents conducted by Kantar Milward Brown and commissioned by Sun Life Financial Philippines, Filipinos are eager to prepare for the future, but are still tied to traditional ways of handling their finances. The study showed 68% of Filipinos were concerned about saving for emergencies, 62% on securing their family’s future, and 57% on retirement. In order to address these priorities, 62% said they are managing their finances while 54% are spending only on things that are planned. Only 39% replied that they were investing their money in order to fund their goals.

This prompted Sun Life to adopt the theme ”Life, Health, and Wealth” for its Financial Independence Month campaign this June.

Life, health, and wealth are the essentials of a brighter future, but one can only achieve them if they save and invest for the future. This is possible with the right partner, tools, and products, and these are what we would like to highlight this Financial Independence Month. – Sun Life Chief Marketing Officer Mylene Lopa

Life solutions

Among the initiatives under ”Life” is the Life Insurance Calculator, which would help one assess how much life insurance he would need to properly cover the needs of his loved ones, giving him a clearer goal to pursue. The digital tool can be accessed via bit.ly/SLlnsuranceCalc.

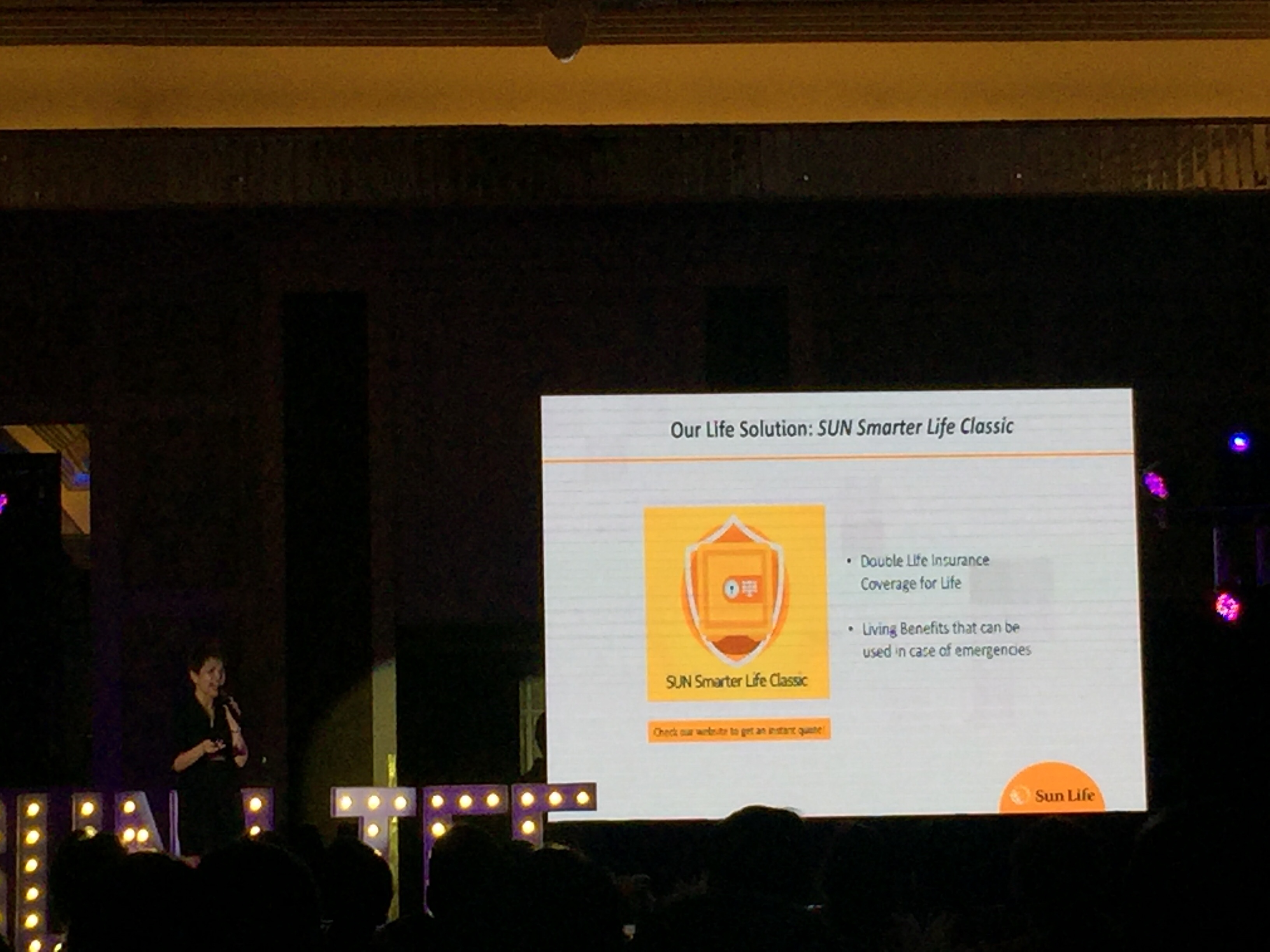

Meanwhile, SUN Smarter Life Classic is a protection plan that provides double life insurance coverage throughout one’s lifetime. Available in flexible premium payments, it also offers benefits that he can use in case of emergencies or immediate need for cash.

Sun Life is also set to team up with Waze to promote road safety in an initiative dubbed ”Brighter Drive, Brighter Life,” which will alert Waze users on accident-prone areas. This may also serve as a reminder for Waze users, who are also registered Lazada members, to insure themselves with a digital life insurance from Sun Life, such as Life Armor. It may be availed via the said online marketplace for as low as P100.

Health solutions

Under ”Health,” Sun Life endorses SUN Fit and Well, a new generation wellness plan that offers comprehensive life and health protection. It covers the whole health Journey from prevention, diagnosis, treatment, and rehabilitation, offering comfort and peace of mlnd should a serious illness strike.

GoWell, Sun Life’s wellness community, has also expanded its tie-up with Fitness First to offer club benefits and preferential rates for Sun Life clients, advisors and employees.

Wealth solutions

Those eager to pursue their wealth goals can give the Investment Calculator 3 try at bit.ly/SL|nvestmentCalc to see how their money can grow over time using various financial instruments.

Once they are ready to start investing, they can opt to invest in the Sun Life Prosperity Achiever Funds from Sun Life Asset Management Inc. (SLAMCI). The first target date investment funds in the Philippines, these funds are designed to help investors achieve their goals on time with the minimum investment at only P1,000.

Should you wish to encourage your loved ones to start their own investing journey as well, you can give them a Sun Life Prosperity Card, 3 gift card which can be invested in any of Sun Life’s peso-denominated funds. It is available in P1,000 and P5,000 denominations.

At the end of the day, the key to having a brighter life is yourself . Once you know your purpose and have decided to work on your goals, you will now do all the means to achieve it – including taking of your health. Achieving financial independence is not easy that’s why Sun Life have offered the above life, health and wealth solutions. And once we are financially independent, let us not forget to help others too.

Wow, wonderful post. Thanks for sharing.

Know your Why talks about one of the points you wrote above. It’s a great book! Check it out!

Nice! Thanks for sharing this informative article.

Informative I’m in the midst of getting my finances In order so that I could start investing my money wisely.

Great tips!

I can’t wait to test these out!

I am a believer in investing. I hope many people will be able to acquire the mindset to set aside a good amount of their salary for investments.

I jave sunlife ge vul. No regrets on having one

very motivational! this should make a huge impact, it may not be seen immediately – but in the long term, the benefit will be huge.

I love the focus on abundance thing. It really changes our perspective to life and so on. Positive energy always helps?.

Such a great article about investing the money I think all people should read this article!

Great article…by the way I am familiar with that model in a white dress. About investing, the topic is always worth the read.

This looks like all in one solution! Great.

Will finish paying for my car in a few months. This is my next project — financial plan. Great reference here!

Such profound wisdom and motivational words! The right investment mindset is key

Financial literacy should be thought at home and at school just like we learn how to read and write. This will avoid for any issues as the kids grow.

I needed to read this today, thank you!

I really liked the writing style you used for this post. I recently just started my insurance plan and I’m a bit scared because it will be eating up a sum of ny money per month, but really reading me once again that I have to be responsible of the future so that I could live my best life.

I would love to attend a very interesting event like this. Also, happy birthday (month)! ☺️

Thank you! I have learn a lot from reading this!!!

Quite inspirational! financial independence is quite important and these solutions are great

“EARN as much as you can, so you can GIVE as much as you can.” I totally agree with this. I think those who are givers are the people who get more blessings!

Everyone should be financially literate. This is a good move of SUN Life. And thank you for sharing to us.

Been reading a lot about insurances. I guess it’s time that I take the right action about this too!

You know what, financial literary must be included in all curriculum at school, both private and gov’t. This way, we are helping the future generation no to be naive and being taken advantage on handling their finances.

Financial Literacy should be a fact of life! Too many people have a terrible relationship with money that could be improved with the right education!

I welcome opportunities like this so I can learn more. Financial literacy is very important and should be a life skill.