Are you curious about what will happen to the financial market amidst the ongoing Covid-19 pandemic? Sun Life Assets Management Company Inc. (SLAMCI), recently hosted a webinar to give an overview of the Market Outlook this coming second half of 2020.

Where are we?

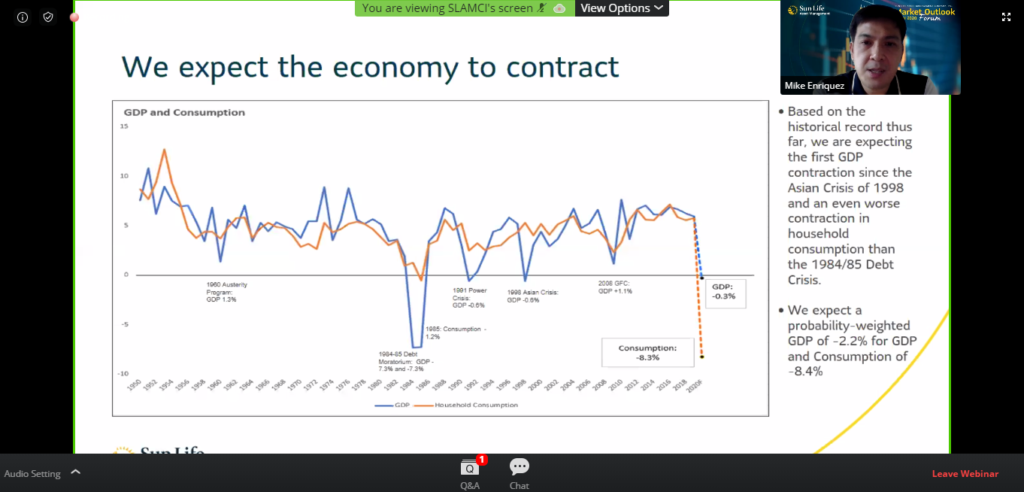

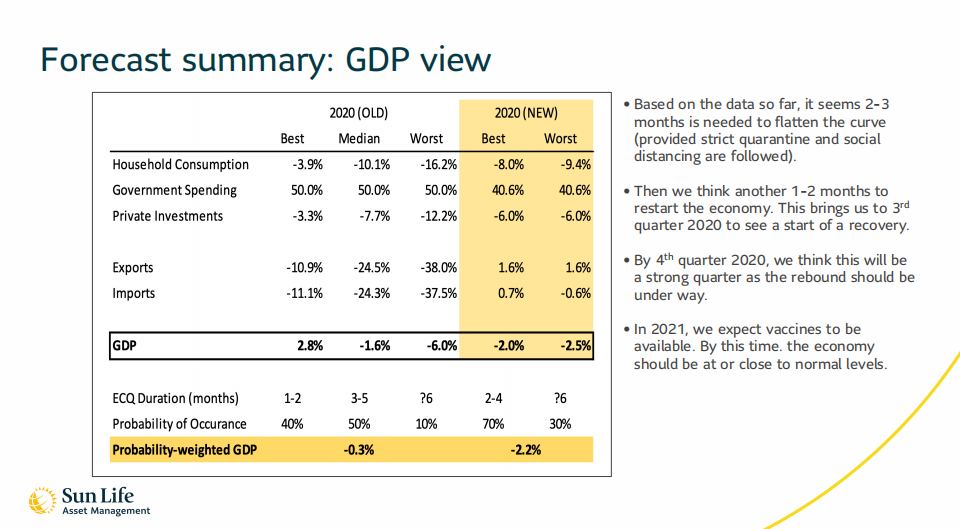

“Based on the historical record thus far, we are expecting the first GDP contraction since the Asian crisis of 1998 and even worse contraction in household consumption than the 1984/85 Debt Crisis,” Michael Gerard Enriquez, Sun Life of Canada (Philippines) Inc. Chief Investments Officer shared during SLAMCI Market Outlook 2020 webinar.

Will we recover?

Businesses will experience the bulk of losses during the 2nd quarter. However, recovery is possible.

“We think the recovery will likely look a U-shaped one with the GDP to initially be weak then slowly ramp up. But markets will be volatile on the recovery phase,” Enriquez said.

Should I invest?

Financial markets have rebounded from their recent low but volatility will continue. The important thing is, there are lots of opportunities for the financial market.

With the current situation, Sun Life continues to provides all services to its clients. As a matter of fact, they provide an easier way to invest through its digital channels – (1) online application, (2) bills payment, and (3) auto-invest. SLAMCI also offers regular financial literacy seminars (webinars during this pandemic).

Whether you’re an existing or an upcoming investor, knowing the market status is significant. Personally, I have mutual funds with Sun Life. Attending this SLAMCI Market Outlook 2020 is a good opportunity to understand what’s happening in the financial market and remove all fears that this pandemic might cause on our investment. We all know that until a vaccine is produced, things will remain uncertain (Low Touch Economy). But if you have an extra budget, it will be good to invest now for a brighter tomorrow. It’s better to prepare early for another emergency like the Covid-19 pandemic. To help you answer the question “When is the best time invest?”, you can read my previous blogs on Money Matters.

DISCLAIMER: Sun Life of Canada (Philippines), Inc. (SLOCPI) and Sun Life Asset Management Company, Inc. (SLAMCI) make no representation as to the accuracy or completeness of the information in this presentation. The information contained here is subject to change without notice and should not be considered as investment advice. Past performance is not indicative of future performance.

Like this:

Like Loading...

Related

I have been thinking of investing in the stock market because the stock prices are low right now. It will be a good investment in the next fee years

I have been thinking of investing in the stock market because the stock prices are low right now. It will be a good investment in the next few years. Thanks for sharing

If you have extra savings, it will definitely be good to invest. You just have to consider your if you’re willing to take a risk, timeline and goals for the investment 🙂

Your blog is very informative and educational. Are you currently working with SunLife Insurance? There are so many insurance companies these days and to tell you the truth, it’s really hard to invest when the whole world’s economy is crashing but this is a nice way of growing our finances and preparing for the future.

Hi! I’m not (yet) affiliated with Sun Life Insurance but I have variable life insurance and mutual fund with Sun Life since 2016.

Yes, it’s a bit fearful to invest nowadays but with the market outlook and more info on investment we can take advantage of the low stock prices 🙂

I have seen a lot of financial advisors posting same topics, but yours explained a bit further. Commonly, now is the best time to purchase stocks as advisors would repeatedly say. I hope I have the wealth to invest but the pandemic has limited my cash flow.

I am not under Sun Life but I have stock investments of my own under COL. It is frightening too see all my stocks go down but they are all blue chip companies so I have high hopes.

I have a close friend na investor and also a financial advisor ng Sunlife. Halos everyday ata siya nag-uupdate about stocks and all about investment. Kaya alam ko rin updates diyan, sana talaga makarecover agad

I have secured mine using VUL but not Sunlife also, here in my place and so far, since mine is long term, I will have to hold for the next 10 years more..

This is very informative. I hope this could reach out more people so they could see the significance of investing and preparing for the future, esp now that we all have experienced this scary pandemic. Stay safe.

honestly i have no idea with stocks. but i hope everything will be positive soon. ang daming affected na kasi.. tamo madaming nag invest sa stocks noon then this happens.. eh for additional savings sana ito diba?

This is so helpful for everyone to gain perspective on exactly what is happening with the world economy, and how it could affect us. This is a great way of educating people so they’d know what they can do to gear up for the future.

This is nice! I actually have fears about investing amid the pandemic but I guess it’s not so bad?

Yup, we’re not in the worst scenario naman and we’re slowly improving na. Best to take advantage of the low prices if you have extra buget 😉

I’m a proud Sunlife client/customer! ? I like how they have helpful agents and they really know how to educate the masses with financial literacy. I think it’s wise to invest in stocks now since the prices are low.

Nice! They are open for online applications. I have been looking for companies where in I can invest my savings. Big dreamer here, I am working hard to be a millionaire at 25 years old. Haha! Will checkout Sunlife’s site.

I don’t invest but I learn a lot from my husband. I also enjoy listening to him and my son discuss these things:-)

Every day is a good time to invest coz you’ll never know if tomorrow is still a good day (hence the pandemic). However, this is the best time to invest coz soon enough it will recover.

I am also planning to feature Sun Life, since I have already invested here. HAHA. I have read from surveys that it is still leading.

Yup, they’re still on the number 1 spot based on recent survey.

PS. I’m not affiliated to Sun Life haha

This was surprisingly easy to read. I never understood money and investment talk, but you’ve explained it very well. Economy’s uncertain right now, but I do hope that we bounce back real soon. Hoping for Covid-19 to dissappear already.

Yeah. that’s what I was exploring for.. thanks. Nat Arlan Barton