I’m 27 years old and I’m proud to say that I have a life insurance.

There’s a common misconception that life insurance is for older people. That’s why the younger generation just shrug it off. I became a Variable Life Insurance policy holder two years ago. Some might say that it’s too early; but I realized that I should have started investing earlier. Let me share my reasons and realizations why getting an insurance at a young age is definitely worth it.

We can give so much more to our family.

The main reason I decided to get a life insurance is because I’m an only child. I told myself that if something happens to me (since I have lots of out of town media coverages then), I will have some money left for my parents because I help my parents as much as I can. There was even a time when half of my savings I automatically gave for my late father’s medicines. We don’t know what will happen to us any time. It’s not being pessimistic but it’s better to prepare early than to cram and suffer later.

We still have fewer expenses.

I believe it’s easier to pay your life insurance premium while you’re still young because we have fewer expenses. While we have our own respective expenses (i.e. mobile phone postpaid plans, apartment rentals, food allowance etc.), we can still squeeze in our budget paying the monthly/annual premium if we really wanted to because we’re not yet raising a baby or sending a child yet to school. Believe me, it’s just a matter of proper budgeting.

We can squeeze it in our budget because it’s not that expensive.

The younger you are, the lower the price will be to insure you. There’s an ideal life coverage for every individual depending on the benefit amount, age and gender. Based on the ideal computation for me, my monthly premium should be around Php 7,000+ a month. But since I was helping my parents and funding my MA studies, I chose to be realistic and pay only the premium that I can. Good thing, Sun Life Financial allows you to customize your policy. I got the life coverage Php 500,000 that corresponds to an annual premium of Php 12,000.00 or Php 1,000.00 only every month. This would just mean skipping about five (5) Starbucks coffee or a couple of movie dates. A little sacrifice won’t hurt because in the end, we’ll receive our reward. With the insurance policy I got, I’m insured until I reach 88 years old.

(Tip: It’s best to talk with a financial advisor and request for a proposal that would best fit your needs and budget)

We can also have an investment.

Unlike the traditional life insurance, I got the the variable life insurance (VUL). This kind of insurance provides you a life coverage and at the same time grow your money. This means, we can enjoy our money and use it for our personal/family needs while we’re still active. Based on my policies’ projected benefits, I might have an investment fund value of more than Php 100,000 on my mid 30s to almost a million when I reach my senior year. (Note: values mentioned may change depending on actual investment return)

We start our premium payment early so we can finish paying early too.

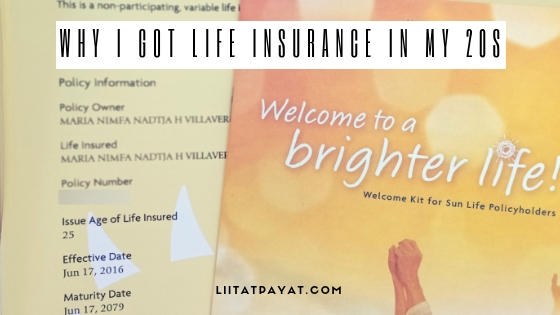

I was just 25 years old when I officially became a policy holder. The variable life insurance policy I got was 10 years of premium payment. So, I will finish paying my premium when I reach 35 years old. This would just mean that I can enjoy my life and focus on my own family without worrying for the future. Imagine if we all started when we’re just 18 years old, by this time, we could have almost finished paying our premium before we reach our 30s. But don’t worry, as the saying goes, it’s better late than never.

(Tip: You can get more than one insurance policy. Once you’re done paying your first policy (or if you have additional budget), you can get a new one for another goal like health plan.)

Life insurance has been and will always be close to my heart. Every day is a reminder of Daddy’s love for us because my mom and I won’t be able to carry on with the new chapter on our life. (Click here to read my story on Life Insurance: Daddy’s Symbol of Love for Us) That’s why I know that my decision to get my own life insurance at a young age is right and I’m sure Daddy is proud of me and my advocacy for financial literacy.

To my fellow millennials who have invested in variable life insurance and other investment options, kudos to your wise financial decisions. For those who doesn’t have yet and are planning to invest, don’t worry. As the the saying goes, it’s better late than never. The power of breaking the cycle of financial dependency is in our hands.

You’re very smart to invest in life insurance at an early age. I wish I had done the same thing but it’s never too late.

It’s always great to be prepared and know that whatever happens all will be taken care of, I still don’t have life insurance yet but I need to start thinking about it.

I think life insurance, even in your 20s, is an excellent idea. I have been looking into getting life insurance as well since I have young kids and wouldn’t want to leave them with nothing in case of an unforeseen accident,.

I love the idea of a policy that you pay into for a set amount of years!! Must be great to have an end point and know you covered your family’s needs!

This is great insight on life insurance. I work in the estate planning field and purchasing proper life insurance is usually a good choice to make when you are young and healthy. It definitely provides a sense of security and investment.

Life insurance is one of those things that is good to have. Thankfully my husbands job provides it for us.

I think life insurance can be a really important thing for anyone to invest in. I have to admit it isn’t something I have got yet, perhaps if I had children or anyone to leave behind something to I would think differently.

people underestimate needing life insurance so young so good for you!

You are intelligent and responsible. These are great tips that I wish I had in my 20’s. The benefits of life insurance is priceless.

Most definitely, insurance is must have. I will definitely be drilling this into my kids as they grow older.